Streamline Your Indirect Lending Processes with nCino

Designed to help FIs scale their lending programs with efficiency and informed data metrics, nCino’s Indirect Lending product connects proven, best-in-class technology with business strategy to help FIs maximize their competitive edge.

The Power of the Platform

All indirect lending activity is visible in nCino’s Consumer Solution through a nightly sync based on core data. Although customers can use our Indirect Lending product as a stand-alone product, FIs using nCino’s Consumer Solution in conjunction with our Indirect Lending product will have the tech stack they need to succeed in a competitive marketplace while delivering exceptional service to customers and dealer partners.

Real-time connectivity to dealers via application platforms, including Dealertrack, RouteOne, and AppOne

A digital document feature designed to supply an efficient and paperless loan documentation process

Ability to pull real-time credit reports from the three major bureaus

A wide selection of scoring models to help with decisioning and underwriting

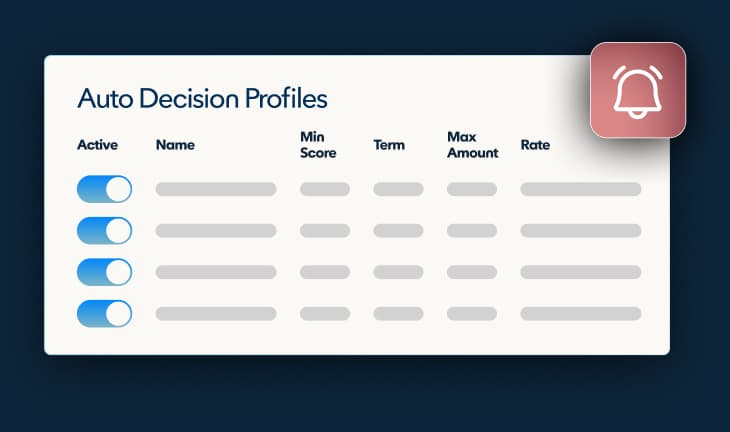

Fully configurable rate matrices and auto decisioning

Support for touchless transactions up until funding

Customized forms pre-filled for printing at dealership

Welcome letters tailored to fit your business operations

Speed to Decisioning and Security Are Essential

At nCino, we recognize the significance of swift decision-making and transparent communication with dealers for ensuring a positive experience. Offering technology that is both secure and compliant is a key aspect of nCino’s commitment to excellence.

Funding tools, including ACH funding to dealers

Comprehensive Alert System

Real-time dealer communication that speeds processes and tracks messages with the deal in question

Two-Factor Authentication

Ready to Transform Your Institution?

Trusted by over 1,800 financial institutions, our platform will enhance strategic decision-making, risk management, and customer satisfaction at your institution. See our best-in-class intelligent solutions in action—request your free demo today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.