Powerful analytics enabling data-driven solutions

Identify, measure, and monitor loan, deposit, and application data to help your institution make efficient data-driven decisions, reduce risk, and meet regulatory and compliance requirements with nCino's Portfolio Analytics solution.

An Analytics Platform That Delivers Intelligence and Effective Risk Management

nCino’s Portfolio Analytics Solution centralizes disparate data sources into an easy-to-use automated platform to identify areas of risk, uncover new growth opportunities, meet regulatory requirements, and drive efficiency.

Reduction in number of regulatory findings

Reduction in time spent on preparing the allowance

Reduction in hours per month building reports

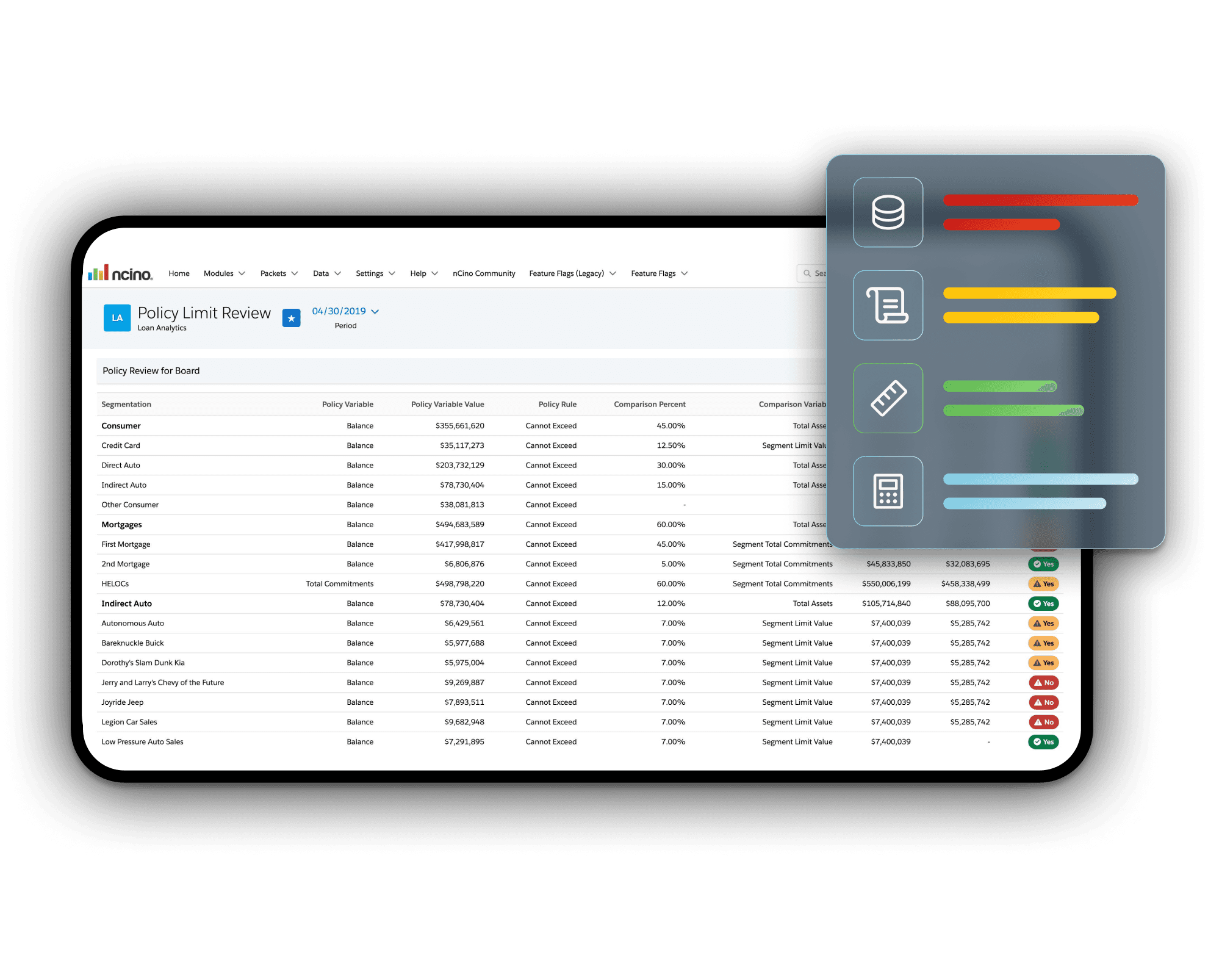

Portfolio Management

The platform provides automated insights into a financial institution's portfolio performance, risk exposure, and profitability, while empowering proactive decision-making and increasing efficiency.

Loan Analytics - Identify, measure, and monitor risks, opportunities, and profitability across the portfolio.

Deposit Analytics – Review the deposit portfolio trended by product type, branches, maturity schedule, correlations, and more.

Application Analytics - Easily analyze loan applications for approval rates, key performance metrics and 'what-if' scenarios.

Customer Analytics - Link and filter a customer's various accounts for a holistic view to better understand customer relationships.

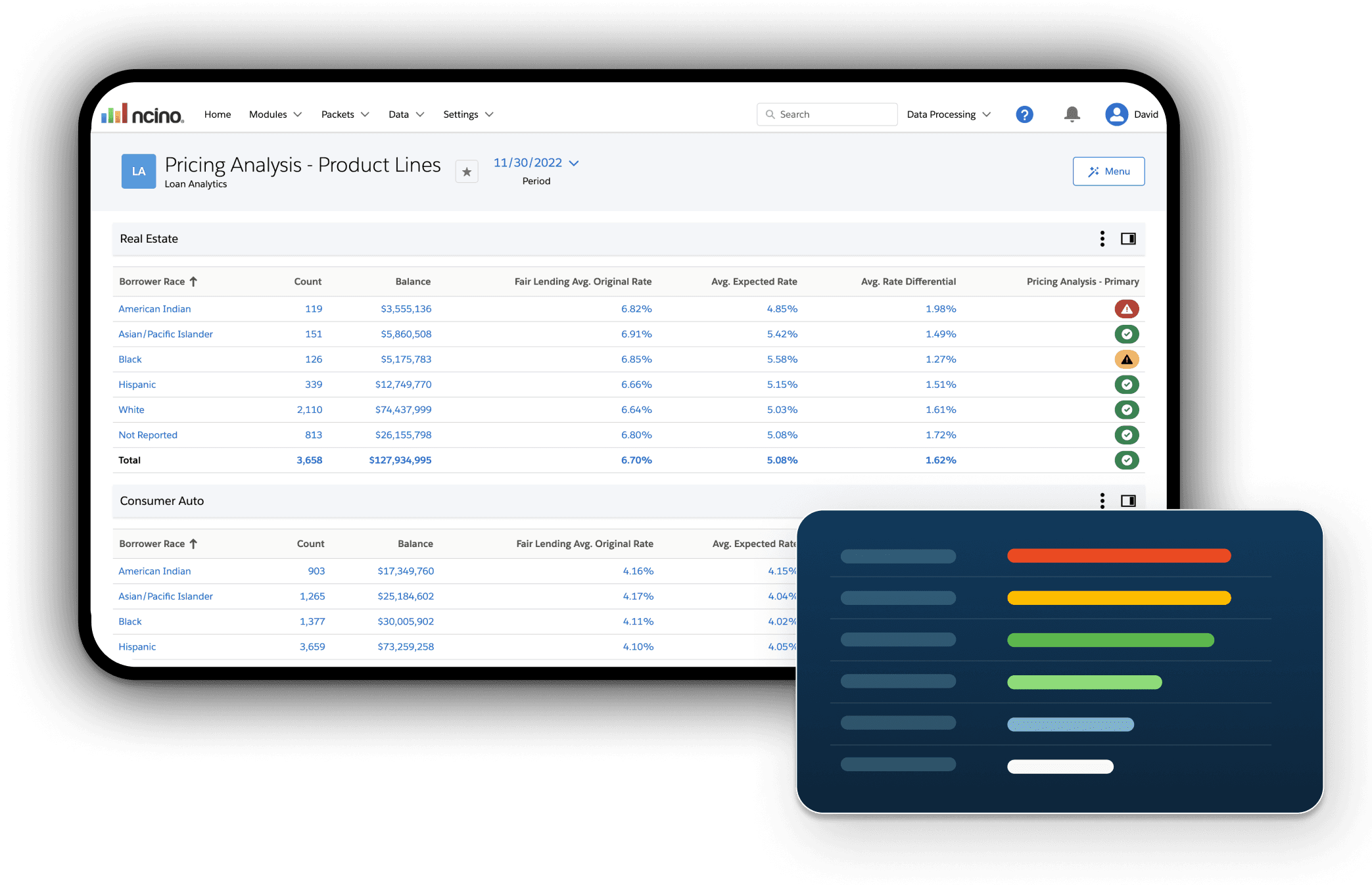

Regulatory Compliance

Stay confidently compliant with the latest CECL and Fair Lending regulations with the solution that enables financial institutions to pass regulatory exams with ease.

CECL – Appropriately reserve for allowance and provide the required documentation and disclosures utilizing a robust set of expected loss models.

Fair Lending – Ensure fair treatment of customers and avoid disparate impact with pricing discrimination, steering, redlining, and application denial analysis tools.

Advisory Services

Take analysis to the next level by partnering with the Advisory Services Team who will provide an expert, outside perspective, and help prepare for future analysis.

CECL Advisory Services – Gain full confidence in CECL strategies and maintain regulatory compliance by partnering with a team of industry experts.

Fair Lending Training and Analysis – Equip lending teams with regular fair lending training and receive a full analysis of potential pricing discrimination, steering, redlining or application denial issues across all portfolio segments.

Regulatory Exam Preparation - Feel assured during regulatory exams with a full data analysis, review of policies and procedures, and remediation plans for identified gaps.

Portfolio Risk and Opportunity Analysis - Develop strategic plans for executive teams to better manage risk and identify growth opportunities for lending and deposit products.

nCino has allowed us to increase our commercial portfolio and I have no doubt we could not continue to grow without the tools they have provided us for portfolio management.

Kerri Schoolcraft

Spokane Teachers Credit Union

Ready to Transform Your Institution?

Trusted by over 1,800 financial institutions, our platform will enhance strategic decision-making, risk management, and customer satisfaction at your institution. See our best-in-class intelligent solutions in action—request your free demo today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.