ASB Successfully Activates nCino to Help Transform Business Lending

Top three New Zealand institution by asset size is live on nCino following implementation journey during pandemic.

5 Banking Predictions for 2025

Stay up to date with the latest news, thought leadership, and happenings around nCino through our Newsroom.

Read NowTop three New Zealand institution by asset size is live on nCino following implementation journey during pandemic.

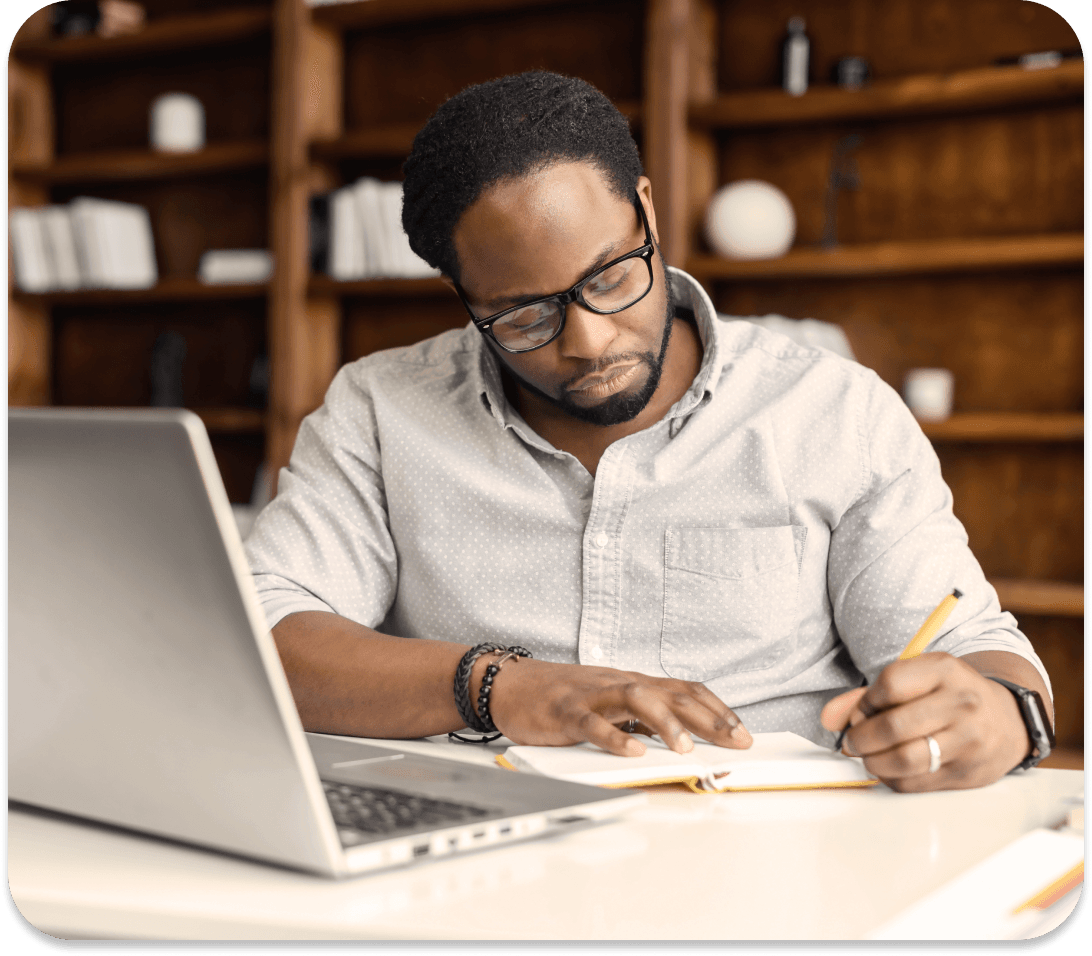

Today’s consumers no longer compare banks solely with other banks. Instead, they’re weighing the convenience, speed, and personalization of their financial institution against the service they receive from companies such as Netflix, Uber, and Amazon. And in many cases, traditional banks limited by cumbersome manual processes simply can’t keep up.

This is perhaps most apparent in the deposit account opening process, where asking a customer to enter sensitive financial information and then wait up to three days to verify micro-deposits can feel slow, frustrating and full of friction.

This year, nCino plans to attend over 50 conferences and events. These events give us an incredible opportunity to share our industry expertise, engage with our partners and connect with our customers. They also give us a chance to demonstrate the many benefits of the nCino Cloud Banking Platform and show how our cloud-based platform offers financial institutions the speed, flexibility and customization to scale their business and meet their customers’ needs and expectations.

In this quarterly series, we’ll be highlighting nCino’s upcoming attendance at some of the most influential networking and learning events in the financial services industry. Let us know if you’ll be attending any of the following events—our team looks forward to seeing you “On the Road!”

Credit union chooses fintech to streamline account opening for complex commercial businesses

nCino's annual user conference, nSight 2022, brought together industry professionals, including representatives from global banks, regional banks and credit unions. The conference celebrated its 10th anniversary and marked the return of an in-person event after almost three years. Highlights included customer presentations, a transformed Community Lounge, nCino University certifications and the introduction of SimpleNexus homeownership solutions. The conference provided an opportunity for networking, knowledge sharing and a renewed sense of collective innovation within the industry.

nSight 2022, nCino’s annual user conference, was memorable for many reasons. We brought together approximately 1,400 people—including representatives from global enterprise banks, regional and community banks and credit unions—to hear from industry leaders, discuss key banking and economic trends, share best practices and explore the latest features and functionality of the nCino Bank Operating System. It was also nSight’s 10th anniversary and our first in-person user conference in nearly three years.

To say we were excited would be an understatement.

It’s impossible to choose one favorite moment from nSight, so instead we'd like to share five highlights from a week spent with the best customers, partners and colleagues in the industry.

WILMINGTON, N.C. – June 27, 2022 – nCino, Inc. (NASDAQ: NCNO), a pioneer in cloud banking and digital transformation solutions for the global financial services industry, today announced that Chris Ainsworth has joined the Company as its first Chief People Officer, serving as a member of the nCino Executive Leadership Team.

“At nCino, one of our highest priorities and most valuable assets has and will continue to be our people,” said Pierre Naudé, Chairman and Chief Executive Officer of nCino. “Chris brings to nCino more than two decades of experience and a proven track record of leading high-performing human resources and talent teams in complex global financial organizations. I am confident his knowledge and perspective will enable us to continue attracting, hiring, developing and retaining the best people in the industry and around the globe.”

Texas Farm Credit, Great Southern Bank and Natixis CIB named recipients of Financial Services Impact Awards at nSight 2022. Nominations judged by leading global research and advisory firm Celent.WILMINGTON, N.C., June 16, 2022 — nCino, Inc. (NASDAQ: NCNO), a pioneer in cloud banking and digital transformation solutions for the global financial services industry, today announced the winners of the nCino Financial Services Impact Awards, the company’s second-annual customer awards program. This year’s nominations were judged by a team of analysts at Celent, a member of the Oliver Wyman Group and the leading research and advisory firm focused on technology for financial institutions globally.

At nSight 2022, held June 7-9 in Raleigh, North Carolina, nCino was proud to announce the winners of its second annual Financial Services Impact Awards.

These awards recognize nCino customers of various asset sizes from across the globe for how their use of the nCino Cloud Banking Platform has positively impacted the financial services industry. A team of analysts at Celent, a leading research and advisory firm focused on technology for financial institutions globally, judged nearly 20 outstanding nominees.

This year’s finalists included financial institutions from multiple countries, across a variety of asset sizes and multiple business lines including corporate and investment banking, commercial banking, retail banking, mortgage lending and agriculture lending. The three winners, celebrated at nSight during a special ceremony, are recognized for their game-changing achievements in client service, contributions to their communities and improvements to their employees’ experience across three categories: Innovation, Reputation and Speed.

Consumers now expect quick and convenient digital services, but a Deloitte survey shows that a personal connection through human interaction remains crucial in retail banking. nCino has partnered with Glia to enhance digital customer service, allowing financial institutions to meet customers' preferred communication points, resulting in increased Net Promoter Score (NPS), sales, and reduced abandonment rates, thereby offering a consistent and meaningful experience across all channels.

Ready to Transform Your Institution?

Trusted by over 1,800 financial institutions, our platform will enhance strategic decision-making, risk management, and customer satisfaction at your institution. See our best-in-class intelligent solutions in action—request your free demo today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.