Incentive Compensation

Managing incentive compensation can involve a lot of paperwork. Manual processes can be labor-intensive, error-prone, and lacking flexibility and scalability, which makes it difficult to manage one of the largest loan origination expenses.

Overview

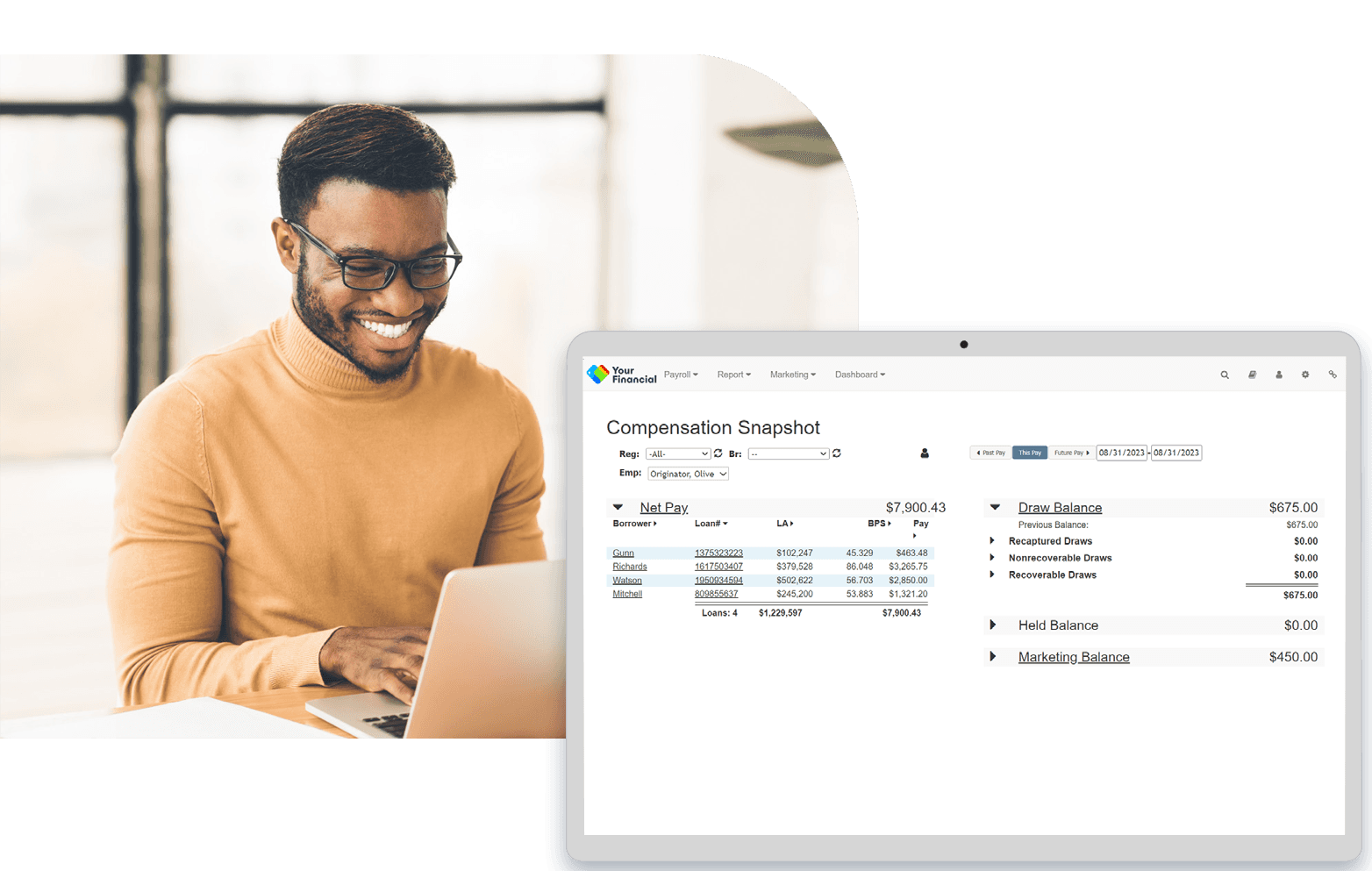

Incentive Compensation helps you tackle these challenges and drive production and performance. It’s an automated incentive compensation management product that saves countless hours each payroll period and delivers accuracy, transparency, and flexibility.

Empowering Your Team

Streamlining accurate incentive compensation processing

Simplifying complex commission plan calculations

Providing greater transparency into loan compensation calculations

Providing insight into performance

Storing historical data so it’s easily auditable

For data governance, there are various levels of access and permissions for users, so you can control who can view which data.

There are 100+ robust and on-demand reports that can be viewed, filtered, or downloaded for further data analysis.

Single Source of Truth

All your loan compensation data, transactions, and communications are in one place to manage, audit, analyze, and report on at any time. With automated tracking and reporting of every loan commission calculation and transaction, Incentive Compensation by nCino helps financial institutions stay compliant with the Consumer Financial Protection Bureau (CFPB) LO Comp Rule.

All I have to do is press a button to export our payroll file for the pay period then upload it to our payroll system.”

Zach Davis

Senior Mortgage System Administrator

¿Listo para transformar tu institución?

Más de 1.850 instituciones confían en nuestra plataforma para optimizar decisiones estratégicas, gestión de riesgos y satisfacción del cliente. Solicita hoy tu demostración gratuita y descubre nuestras soluciones de primer nivel.

Este sitio está protegido por reCAPTCHA y Google política de privacidad y Términos del Servicio aplicar.