Being a leader in the financial services industry requires a seamless approach to innovation and efficiency. One of the crucial elements to success is the integration of automation and augmentation into credit portfolio management, as these tools have the ability to transform operations, manage risk, and improve both banker and client experiences.

The Benefits of Automation in Credit Portfolio Management

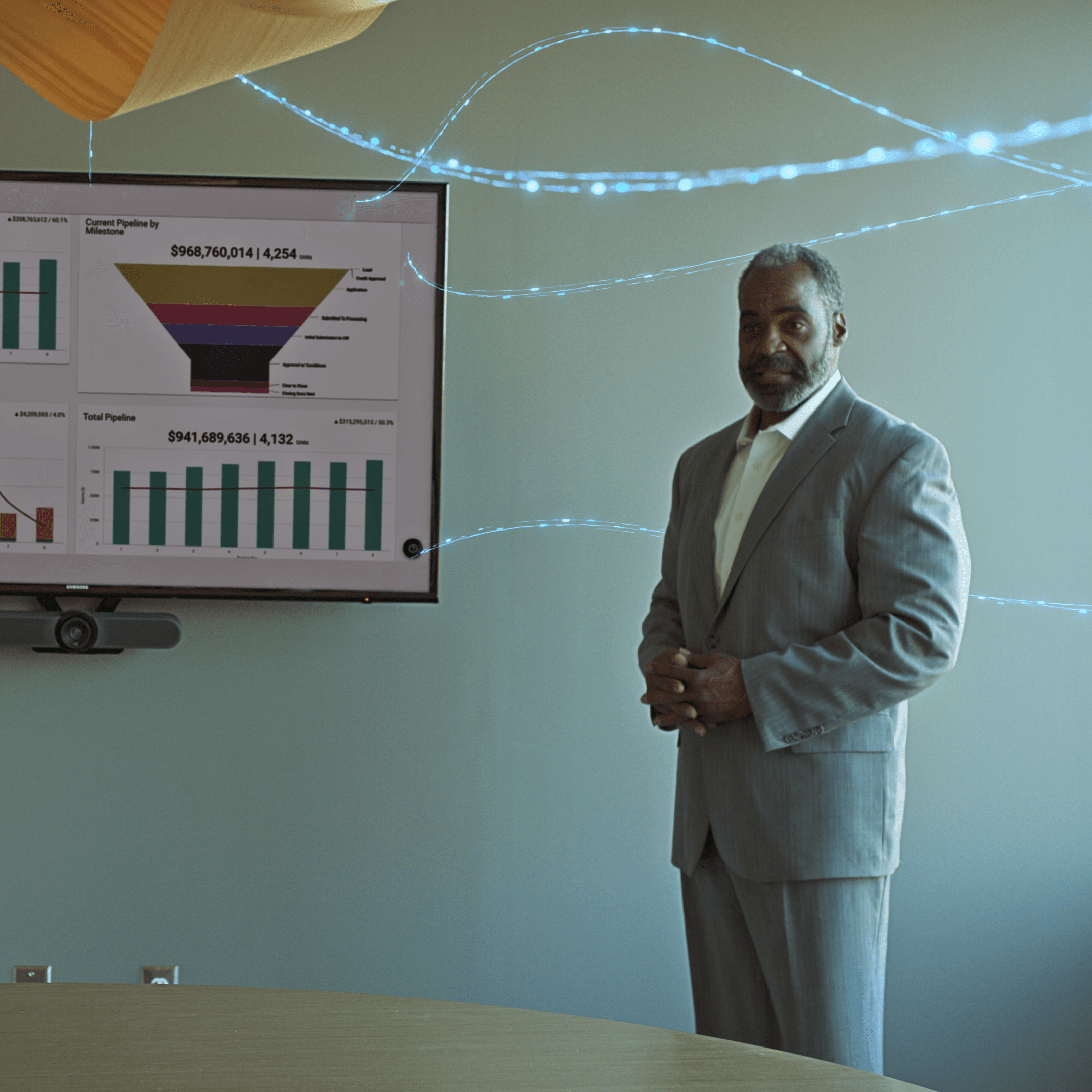

Automation in credit portfolio management is the ability to streamline workflows, improve productivity, and increase collaboration while reducing overhead and reporting costs.

With automation in lending, workflows can become streamlined and connected, ensuring faster detection of at-risk loans. An automated system can also provide increased visibility and collaboration, while helping financial institutions react nimbly to market changes and increasing portfolio optimization.

The Impact of Credit Portfolio Augmentation

While automation cuts down inefficiencies, augmentation fills the gaps left by reactive credit risk management strategies, which can often miss insights and opportunities due to siloed data, incomplete view of risk, and less informed decision making.

Through augmentation, financial institutions can build a centralized data system with robust risk management frameworks and data architectures. This move towards proactive credit portfolio management can aid in strategic decision making and in identifying new opportunities for profitable growth.

Together, automation and augmentation can reduce your institution’s credit losses by 20 to 30% and decrease monitoring costs by 30 to 40%. But the benefits go far beyond just numbers—by integrating these tools, your financial institution could become more efficient, innovative, and customer focused.

As the financial industry continues to evolve, risk management transformation is not just an option, but a necessity.

Ready to supercharge your credit portfolio management? Download the full infographic today to learn more about the power of automation and augmentation.