Streamline Your Indirect Lending Processes with nCino

Designed to help FIs scale their lending programs with efficiency and informed data metrics, nCino’s Indirect Lending product connects proven, best-in-class technology with business strategy to help FIs maximize their competitive edge.

Review the Indirect Lending Product SheetThe Power of the Platform

All indirect lending activity is visible in nCino’s Consumer Solution through a nightly sync based on core data. Although customers can use our Indirect Lending product as a stand-alone product, FIs using nCino’s Consumer Solution in conjunction with our Indirect Lending product will have the tech stack they need to succeed in a competitive marketplace while delivering exceptional service to customers and dealer partners.

Real-time connectivity to dealers via application platforms, including Dealertrack, RouteOne, and AppOne

A digital document feature designed to supply an efficient and paperless loan documentation process

Ability to pull real-time credit reports from the three major bureaus

A wide selection of scoring models to help with decisioning and underwriting

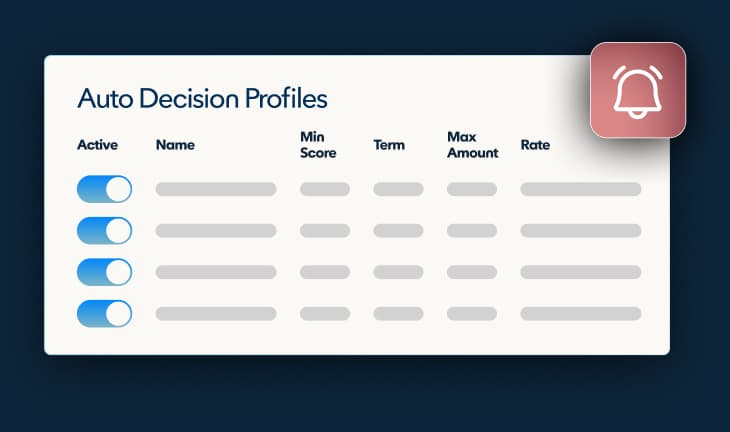

Fully configurable rate matrices and auto decisioning

Support for touchless transactions up until funding

Customized forms pre-filled for printing at dealership

Welcome letters tailored to fit your business operations

Speed to Decisioning and Security Are Essential

At nCino, we recognize the significance of swift decision-making and transparent communication with dealers for ensuring a positive experience. Offering technology that is both secure and compliant is a key aspect of nCino’s commitment to excellence.

Funding tools, including ACH funding to dealers

Comprehensive Alert System

Real-time dealer communication that speeds processes and tracks messages with the deal in question

Two-Factor Authentication