Building Customer Loyalty in Mortgage Lending: Insights from our Executive Breakfast

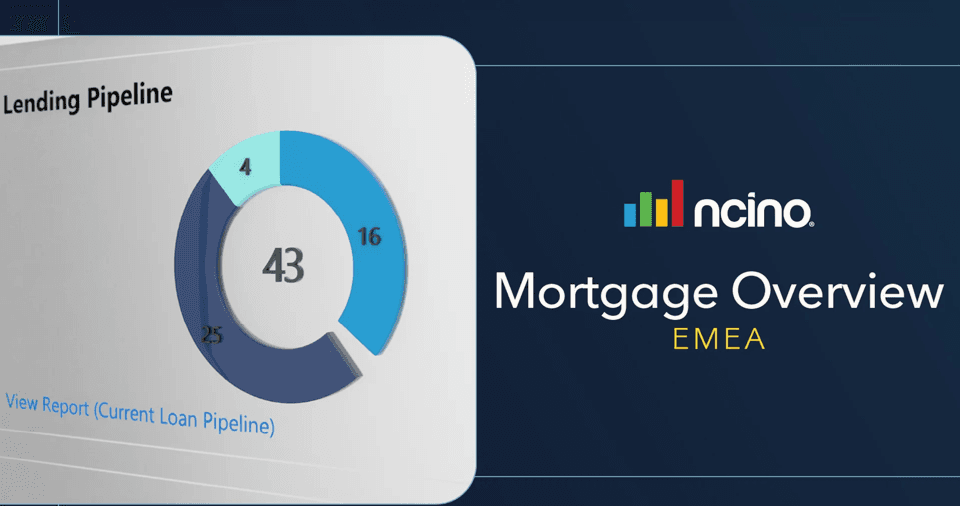

Mortgage lending is competitive, and customers expect fast, personalised, digital-first experiences throughout their home-buying journey.

Solicite una DemoSimplify the entire loan process and replace manual tasks with automated workflows for faster responses and better customer experiences.

With a configurable, data-driven platform, lenders can deliver a personalised experience across multiple channels for improved customer satisfaction and retention.

Read the Brochure

Exceed customer expectations with faster decision-making, a personalised experience and a more transparent process.

"Combining agile cloud-based technology has set Santander International apart from the competition, driving significant market share, returning customers, and nearly £1bn in new lending"

Santander International

improvement in time to generate offer letters, from 3 hours to 30 minutes.

application volume growth in two years with nCino.

paperless environment as a result of transformation.

reduction in time from application to completion

"We invested in nCino because it automates tasks, allowing colleagues more time to deliver differentiated and personalised service."

Phil Green

Head of Commercial Lending at Yorkshire Building Society

Build long-term, profitable relationships by offering competitive rates and flexible products and propositions for an exceptional customer service.

Once you decide to modernise your mortgage platform, the critical question is which platform or approach do you choose?

In this guide, we arm you with the 10 strategic questions to ensure you invest in a platform and partnership that aligns with your needs today, and into the future.

Read the White Paper

Use intelligent automation and AI to improve underwriting and quickly generate offer documents for better way to provide instant offers.