Impulsar el crecimiento de los bancos comunitarios

Los bancos comunitarios afrontan retos específicos: normativas estrictas, clientes cada vez más exigentes y la necesidad de adaptarse con agilidad al entorno digital. En nCino

Creado para la banca comunitaria

Creado para la banca comunitaria

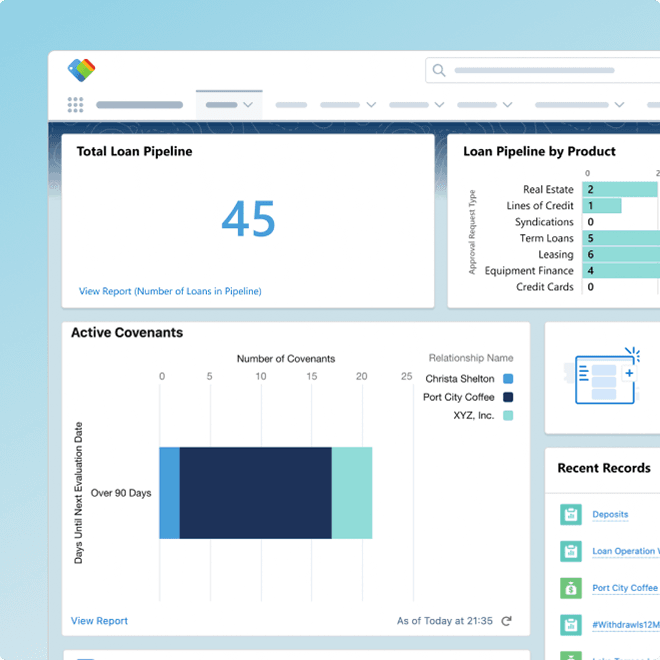

Proporcionamos información basada en datos y un conjunto flexible de soluciones para satisfacer las necesidades específicas de su banco comunitario.

Refuerce las relaciones con sus clientes, optimice los procesos y responda con agilidad a los cambios del mercado, ofreciendo siempre una experiencia personalizada que le diferencie de la competencia.

Your passion. Our innovation

We value your trust to help turn homeownership dreams into reality. As your partner, we remain committed to innovation—developing game-changing technology that will help independent mortgage banks continue serving communities while supporting their production goals.

Un éxito que habla por sí solo

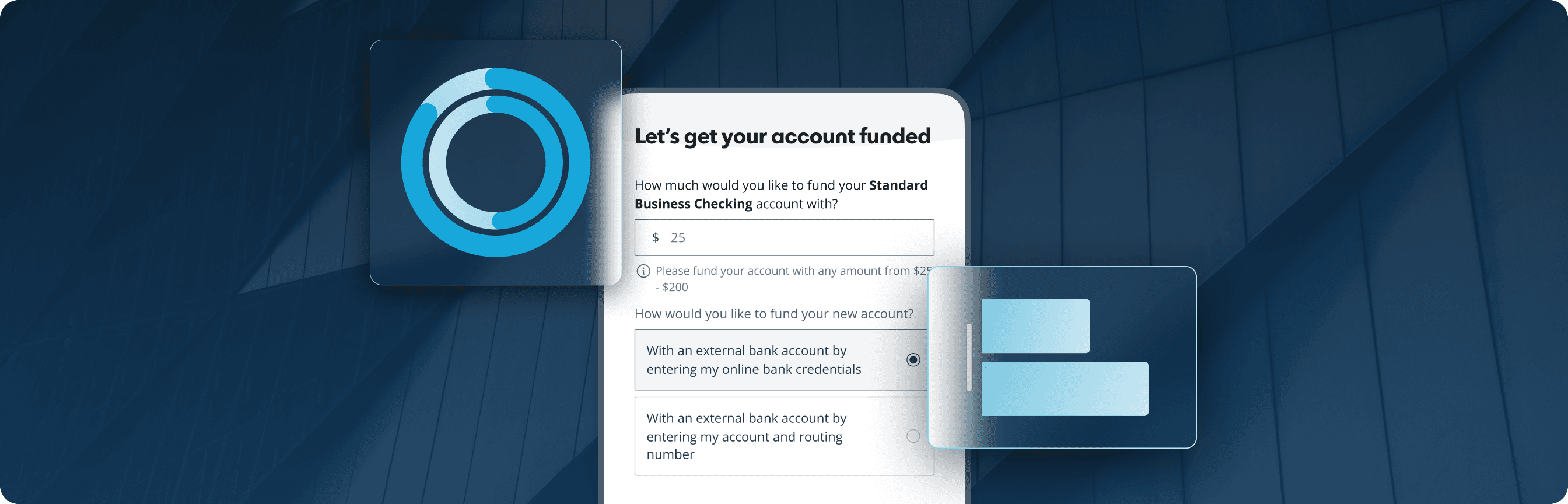

50%

reducción del tiempo de apertura de cuentas en la sucursal

8

plataformas tecnológicas eliminadas gracias a la implementación de nCino Commercial Lending

78%

incremento en los préstamos formalizados

"Al asociarnos con nCino, podemos abrir cuentas en línea de forma más eficiente, rápida y mejor que nuestros competidores, y eso es un valor añadido para nosotros como banco."

Brad Tidwell, President and CEO at VeraBank